The latest industry news

Essential insights and expert commentary across HR and employment law, health & safety, and environmental management. Some Mentor services incur a cost.

HR

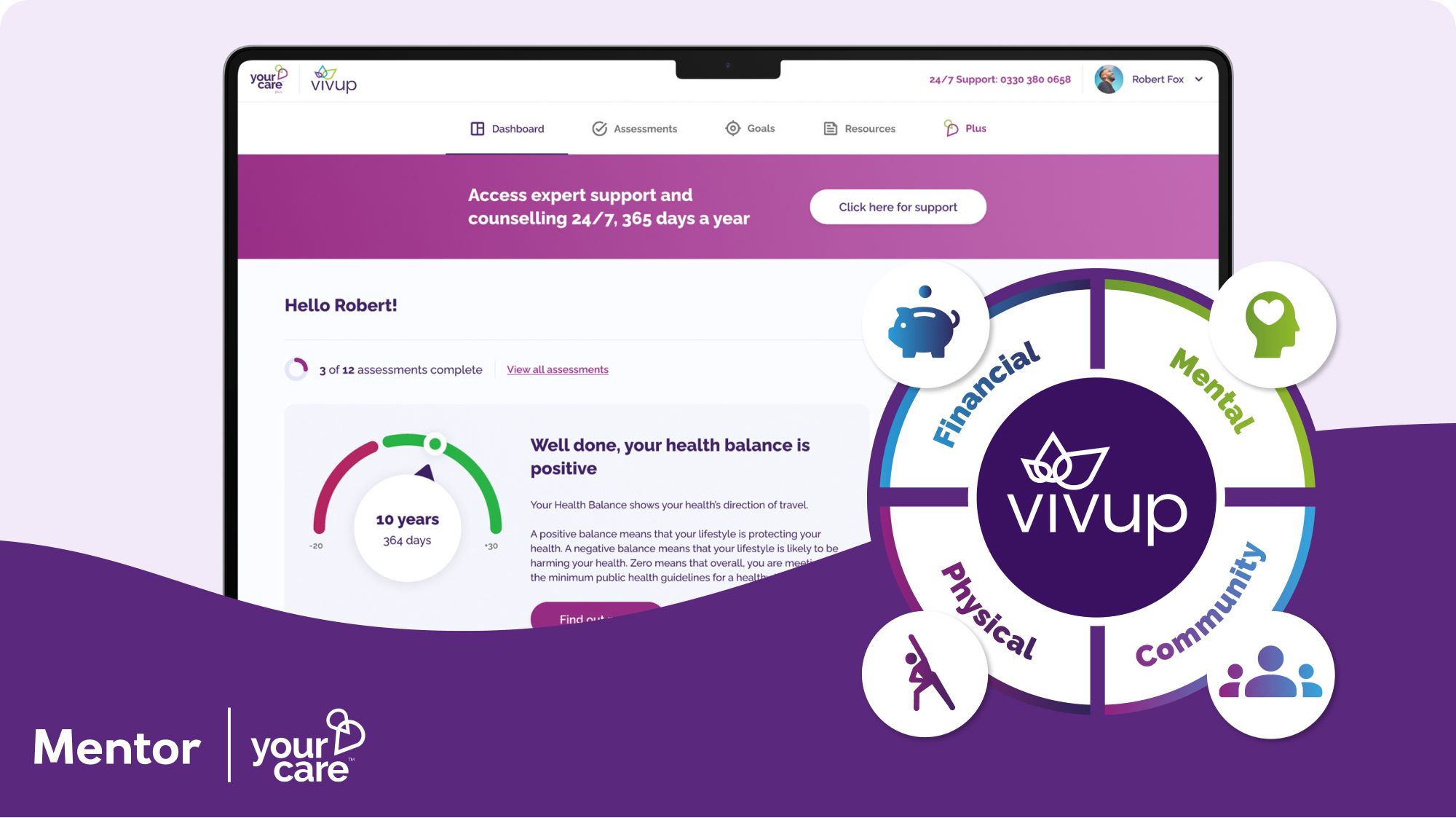

Unlock your employees’ potential with Mentor’s new Employee Assistance Programme

01 May 2025•2 minutes read

Employment law

Sexual harassment legislation - a roadmap for employers

20 Jan 2025•5 minutes read

Employment law

What does the Employment Rights Bill mean for your business and workers?

31 Oct 2024•6 minutes read

HR

Flexible working rules: Are employers up to speed?

23 Oct 2024•19 minutes read

Employment law

New rules on allocating tips at work: What employers need to know

09 Sep 2024•3 minutes read

Health and safety

UK protests: putting employees first in times of uncertainty

14 Aug 2024•3 minutes read

Employment law

What does the new Labour government mean for employers?

05 Jul 2024•5 minutes read

Employment law

New regulations set to shake up holiday entitlement and pay

09 May 2024•6 minutes read

HR

Supporting employees taking family leave

22 Apr 2024•7 minutes read

Employment law

Flexible working: How the law is changing

13 Feb 2024•4 minutes read

Employment law

Employment law changes in 2024: What you need to know

18 Jan 2024•4 minutes read

Health and safety

How ISO 45001 helps ensure health and wellbeing at work

13 Nov 2023•4 minutes read

Health and safety

Why construction regulations are key to worker safety

03 Oct 2023•4 minutes read

Health and safety

Understanding the benefits of ISO 14001

07 Sep 2023•3 minutes read

HR

Building a DE&I workplace

21 Aug 2023•4 minutes read

HR

Supporting employees during long-term sickness

20 Jul 2023•4 minutes read

HR

National Recovery Month: What does addiction mean to you?

20 Jul 2023•6 minutes read

HR

Respect workplace diversity this festive season and beyond

20 Jul 2023•5 minutes read

Health and safety

Is your business prepared for energy blackouts and bad weather this winter?

20 Jul 2023•5 minutes read

HR

SMEs face a unique set of staffing and HR challenges, new poll reveals

29 Jun 2023•4 minutes read

HR

Attracting talent amid the Great Resignation

29 Jun 2023•4 minutes read

Health and safety

How has Brexit affected health & safety?

29 Jun 2023•3 minutes read

HR

Right-to-work checks: Your duties as an employer

29 Jun 2023•3 minutes read

Health and safety

The new Fire Safety Act 2021

29 Jun 2023•2 minutes read

HR

Lessons learned: Implementing a workplace well-being strategy

29 Jun 2023•5 minutes read

Health and safety

Allergy awareness: stay on top of food safety

29 Jun 2023•4 minutes read

Health and safety

World Day of Safety & Health at Work

29 Jun 2023•2 minutes read

*Some Mentor services incur a cost.

Copyright © Royal Bank of Scotland plc 2025. Registered office: 250 Bishopsgate, London, EC2M 4AA.